For you to attract the best candidates for your organization, you need a competitive compensation package. In this day and age where remote work is on the rise and workers value work-life balance more than ever, a reasonable salary is no longer enough. It takes a well-rounded compensation plan to wow the talent you’re looking for.

So, what all is included in employee benefits?

Ultimately, benefits include everything outside of an individual’s salary. This means health insurance, bonuses, 401ks (4013bs for churches), and vacation days, but for churches, it can also include life insurance, housing allowances, sabbatical packages, education allowances and so much more.

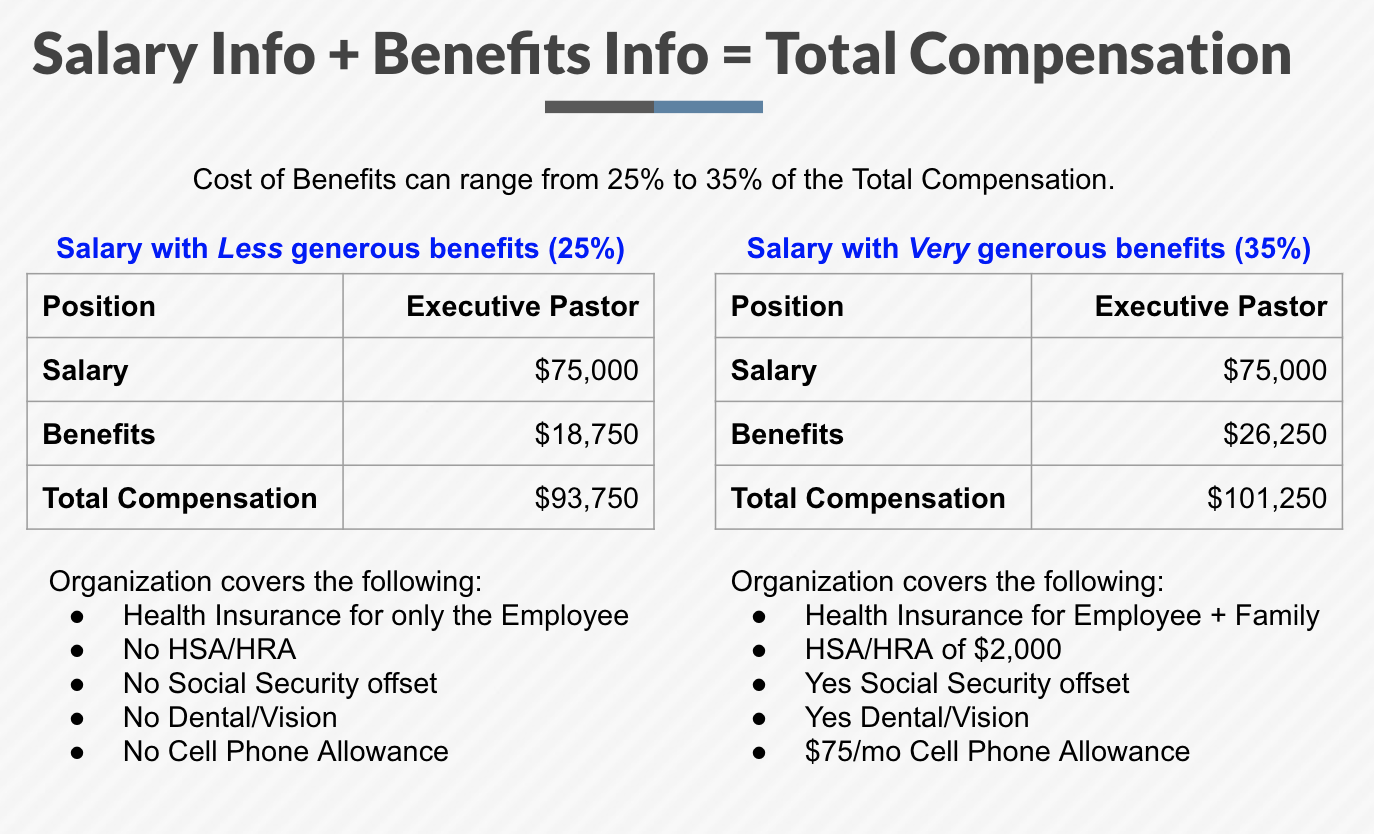

Benefits are so critical because they help employees by cutting out some of their expenses so they are able to use their salary on their other expenses. Providing this added cushion to employees helps them feel more appreciated, boosts their morale, and shows that leadership is dedicated to their quality of life. Because of the highly-positive impact benefits have on employees inside and outside of work, most organizations spend 25-35% of an individual’s salary on benefits.

How do benefits impact overall compensation?

Benefits range from less generous of less than 25% of total compensation, to very generous benefits of above 35% of total compensation. Many times, during the hiring process, these details are not fully discussed but very important in the long run. In the example below, the Executive Pastor receiving less generous benefits will be required to take more dollars from the salary of $75,000 to cover health insurance, dental, vision, phone bills, etc. for his or her family. The Executive Pastor receiving very generous benefits will not have to remove salary dollars to pay for these benefits and might even have money to put away for college savings, retirement or vacations.

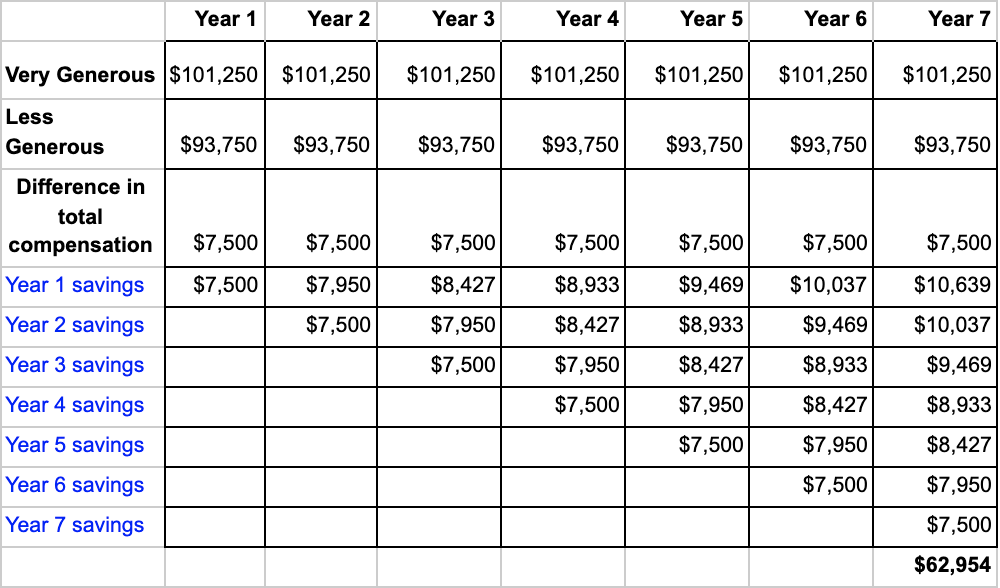

Additionally, health costs normally increase faster than salary year over year. Over the last couple of years, these costs have increased between 4% and 6%. For the Executive Pastor with very generous benefits, these annual increases are included in his/her benefit package and paid for by the church. However, for the Executive Pastor with the less generous benefits, these costs cut into the salary of the pastor trying to keep up with these increased costs.

Here is an example of how benefits impact overall compensation when both employees make $75,000.

Over the course of seven years, the employee at Organization B will be compensated $63,000* more than the employee at Organization A. You can understand the pull that this difference would have on potential employees considering your organization.

*This includes 3% cost of living appreciation

Housing allowances also have a significant impact on an employee’s overall compensation. Housing allowances create space for individuals to decrease the amount of their income that is taxable. For example, if someone is making $75,000 a year and has a housing allowance that totals $25,000 a year, only $50,000 of their income is taxable. This means that the employee is having to pay less in taxes than other employees making the same amount of money without a housing allowance.

As an employer, when you offer perks like housing allowances, you’re showing your staff that you empathize with the stresses of their everyday life and want to support their lifestyle outside of the office. When employees feel supported in all areas of their life, they’re more likely to work harder and longer for your organization.

Why should we offer generous benefits?

As previously mentioned, offering generous benefits ensures that employees are well-compensated for their efforts and can be a useful retention tool. While organizational culture, good advancement tracks, and your mission can draw people in, the truth is, people want to feel financially taken care of.

The difference in a less generous versus very generous benefits package can be very dramatic over the tenure of the staff member, as seen in the chart below. In this example, if an Executive Pastor stays in this current role that offers very generous benefits for 7 years and has a 6% investment return on their retirement account, they’ll be able to reach $62,954. This is a nice bit of retirement over the same period of time and a strong incentive to stay in their role longer.

If your organization offers a competitive salary but poor benefits, an employee is more likely to leave for a position with better benefits, even if the salary is less generous, because benefits boost their overall compensation. Furthermore, generous benefits become increasingly important for employees who are having to relocate, have health concerns, large families, or other accentuated circumstances.

As you begin compensation planning this year, consider the areas where you can make a meaningful impact by offering benefits to your employees that allow them to reduce their out-of-pocket on necessary expenses. Putting employees first in this way will increase their morale, and in turn, their work ethic and tenure.

At Vanderbloemen, we offer custom compensation reports to show you how your organization compares to others similar to yours. Our data even factors in cost-of-living for the most accurate and detailed information available to Christian organizations. Find out if your benefits rank competitively and schedule a consultation with our team to create a well-rounded compensation plan that leaves your employees feeling fulfilled and cared for